Key Points:

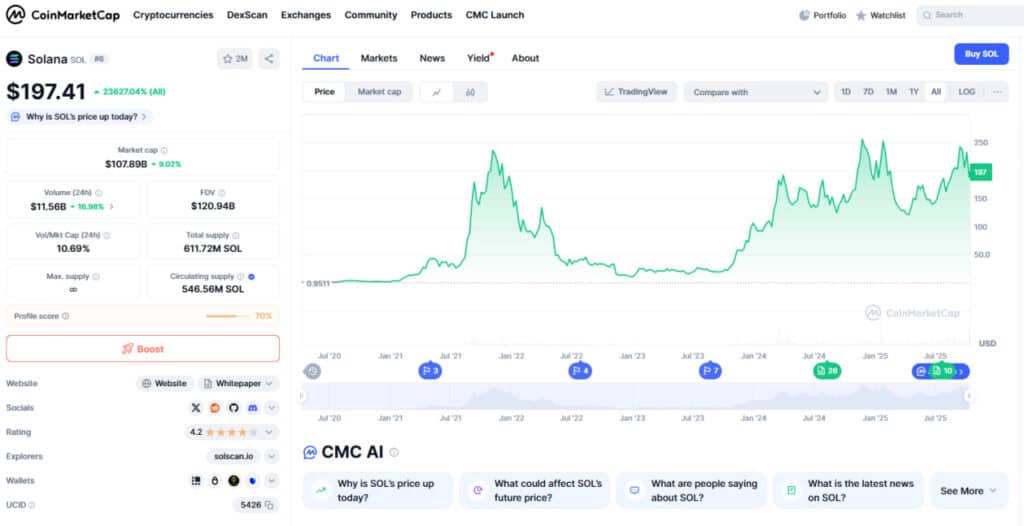

- Solana maintains ecosystem strength amid October’s market correction, backed by steady staking and institutional inflows.

- Market shows reduced volatility panic, signaling greater structural maturity across major altcoins.

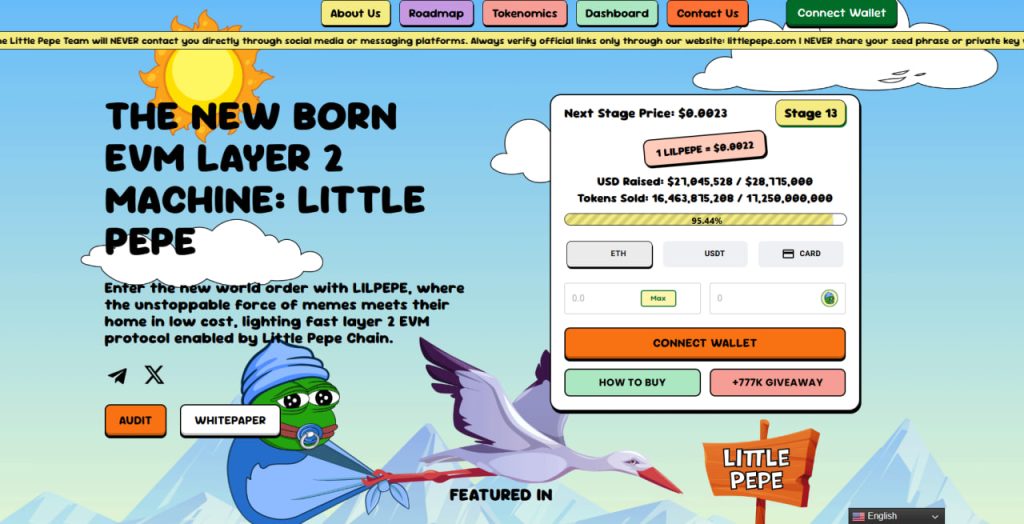

- Little Pepe presale activity hints at rising speculative sentiment within the meme-coin sector.

After the crash on October 10 in the cryptocurrency market, Solana’s network displayed remarkable resilience despite a broad altcoin pullback. On-chain metrics show that staking ratios and transaction counts remained steady, suggesting long-term conviction rather than short-term fear. This indicates a maturing market structure, where large holders favor accumulation and ecosystem growth over reactive selling.

Solana Resilience Reflects Market Maturity

Analysts note that Solana’s behavior during this correction mirrors Bitcoin’s “buy the dip” pattern earlier in the month. Institutional inflows into Solana-linked products exceeded $180 million this quarter, while staking participation surpassed 70% of total supply, the highest since Q2 2024. The network continues to process over 1 million transactions daily with minimal fees, supporting steady usage across DeFi protocols such as Jupiter, MarginFi, and Kamino.

Market Sentiment Shifts to Neutral

The recent downturn triggered limited capital outflow, implying that traders view Solana’s price range between $185 and $200 as a key accumulation zone. Open-interest levels in perpetual contracts declined slightly, aligning with neutral sentiment. Unlike previous drawdowns, the market avoided sharp liquidations, emphasizing how investor psychology has evolved.

Meme Momentum: Little Pepe Adds Speculative Flavor

While Solana anchors the market’s structural side, Little Pepe (LILPEPE) brings a contrasting wave of speculative energy. Now in Stage 13 of its presale, priced around $0.0022, Little Pepe has raised over $25 million, signaling that risk-on sentiment is quietly re-emerging among retail investors.

Analysts see this meme-coin surge as complementary rather than competitive, acting as a sentiment gauge for liquidity appetite. If Solana’s foundation remains stable, projects like Little Pepe could amplify short-term trading enthusiasm without undermining broader market health.

Historical Context and Expert Outlook

During the August 2024 pullback, Solana also showed resilience, but speculative panic was stronger due to macro uncertainty. Today, the reaction is notably calmer, reinforcing the idea that Solana’s investor base has matured alongside improved ecosystem depth.

Marketbit Research notes that ongoing institutional adoption and potential ETF approvals may strengthen Solana’s position heading into Q4 2025. Regulatory clarity and technological innovation could together pave the way for a more stable and efficient Layer 1 market.